Key employee trends and ways HR can respond

"Human-centered." That's the most important word for HR in 2023, according to Kathi Enderes, Senior Vice President of Research for The Josh Bersin Company.

"Your organization needs to be human-centered. Leadership needs to be human-centered," Enderes told us at the recent HR Tech Conference. Several other pioneering thought leaders at the conference also chose "human" as their watchword when we conversed in the Unum podcast booth.

The reason for this emphasis? Today as never before, employees need their employers to focus on them as people, not just workers. A recent LIMRA study showed that employees who feel cared for at work are 7.4 times more likely to stay with their employers.1

We are living through an era of rapidly accelerating change and experiencing a new paradigm in the employee-employer contract. In this new world of work, employers who don't understand this evolution face peril when it comes to attracting and retaining talent — and succeeding competitively.

At the HR Tech conference, thought leaders also called out resilience, flexibility and well being as well as a need for better measurement and data intelligence in the HR function. Today, HR has an enormous opportunity to lean into their role and make a profound difference to employees' lives.

A shaky recovery, an escalating need for support

The pandemic tore huge holes in the safety net for employees in the U.S., and many are still trying to mend their finances. According to a new survey conducted by Unum, more employees are financially fragile than employers may realize.

For example, 46% of U.S. workers have less than $1,000 in their checking/savings account at any given time. Almost half (48%) would be able to maintain their finances for only two months if they had to miss work due to an injury, accident or serious medical condition. This is up 8% since 2020 and is most prominent for Millennials and Gen Z workers.

46% of U.S. workers have less than $1,000 in their checking/savings account at any given time — up 6% since 2020.2

48% of U.S. workers could last 2 months or less if they couldn't work — up 8% since 2020.3

In a time of high inflation, this fragility means many employees are struggling to keep themselves and their families secure they expect their employers to help.

66% of employees say it is the employer's responsibility to make sure they are financially secure and well.4

The benefits that make a difference

One major way to help make employees more financially secure is, of course, employer-provided-benefits. But the benefits that make a difference change over time. While health insurance may always be primary, one benefit has recently been gaining ground: time off.

According to Unum's recent survey, benefits involving time off and flexibility top the list of nontraditional benefits that are most important to today's employees. This makes perfect sense in the context of financial fragility.

Time away from the workplace — especially paid time off — provides a backstop against catastrophe for families with little savings. If the breadwinners become seriously ill or injured, or if the same happens to a child or aging parent who needs care, paid leave can help keep families afloat.

The top three nontraditional benefits employees want today

1. Generous paid time-off program — 39%

2. Flexible/remote work options — 32%

3. Paid family leave — 30%

Source: Unum, Survey of 1,000 Full-time U.S. Workers, November 2022. Survey question: Beyond traditional insurance offerings, which of these other benefits are most important you (select up to 3)?

The same is true for benefits that supplement health insurance — like accident and hospitalization insurance — which help pay out-of-pocket expenses like co-pays and deductibles that can derail a family’s savings plan.

Some employers are experimenting with benefits like emergency savings programs and student debt relief to help make sure employees have more of a cushion against the unexpected, but fewer than a quarter of surveyed employees said they currently had access to these benefits and nearly 4 in 10 employees said their benefits package at work was not strong enough.5

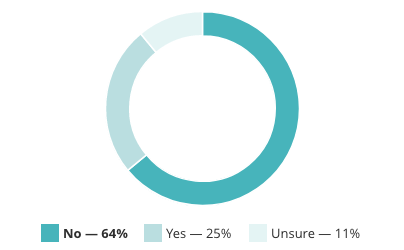

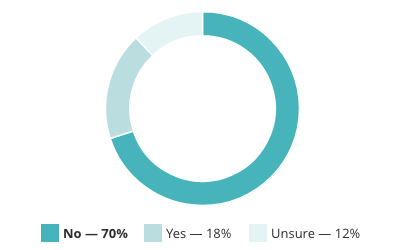

Emerging financial protection benefits

emergency savings option?

student debt relief?

Source: Unum, Survey of 1,000 Full-time U.S. Workers, November 2022.

How HR can lean in

HR can make a difference for all employees — especially those struggling — by taking steps to help them feel cared for and secure. To be a difference maker in 2023, HR can

-

Listen to employees. A well-crafted listening program can provide the information companies need to build a workplace that helps keep employees satisfied and productive.

-

Pay attention to the leave experience. Ensure your leave policies and procedures create an experience that supports employees during stressful times and lets them know they are valued.

-

Foster a culture of belonging. When employees can bring their authentic selves to work, the result is easier talent attraction, higher rates of retention and greater company success.

-

Provide benefits that appeal to your whole organization. Don't focus on family leave alone. Provide as many benefits as you can that offer something to every generation and family configuration in your workforce.

Watch the video above to see what HR thought leaders have to say and hear the full interviews here. How will you make a difference this year?

1 LIMRA, Benefits and Employee Attitude Tracker (BEAT) Study, 2022.

2 Unum, Survey of 1,000 Full-time U.S. Workers, November 2022. Survey question: Not including retirement savings (401(K), IRA, etc.), approximately how much money do you maintain in your checking/savings accounts at any given time?

3 Unum, Survey of 1,000 Full-time U.S. Workers, November 2022. Survey question: If you were to have an accident, injury, or experience a serious medical condition which required you to miss work and affect your ability to earn income, approximately how long would you be able to maintain your finances (rent, mortgage, bills, etc.) without additional financial support or assistance?

4 Employee Benefit Research Institute and Greenwald Research, 2022 Workplace Wellness Survey, 2022.

5 Unum, Survey of 1,000 Full-time U.S. Workers, November 2022. Survey question: Do you feel your employer offers a robust benefits package?